ΓΡΑΦΕΙΟ ΤΥΠΟΥ Δελτία Τύπου

Δελτία Τύπου

Ενημερωθείτε για όλα τα νέα της Εταιρίας

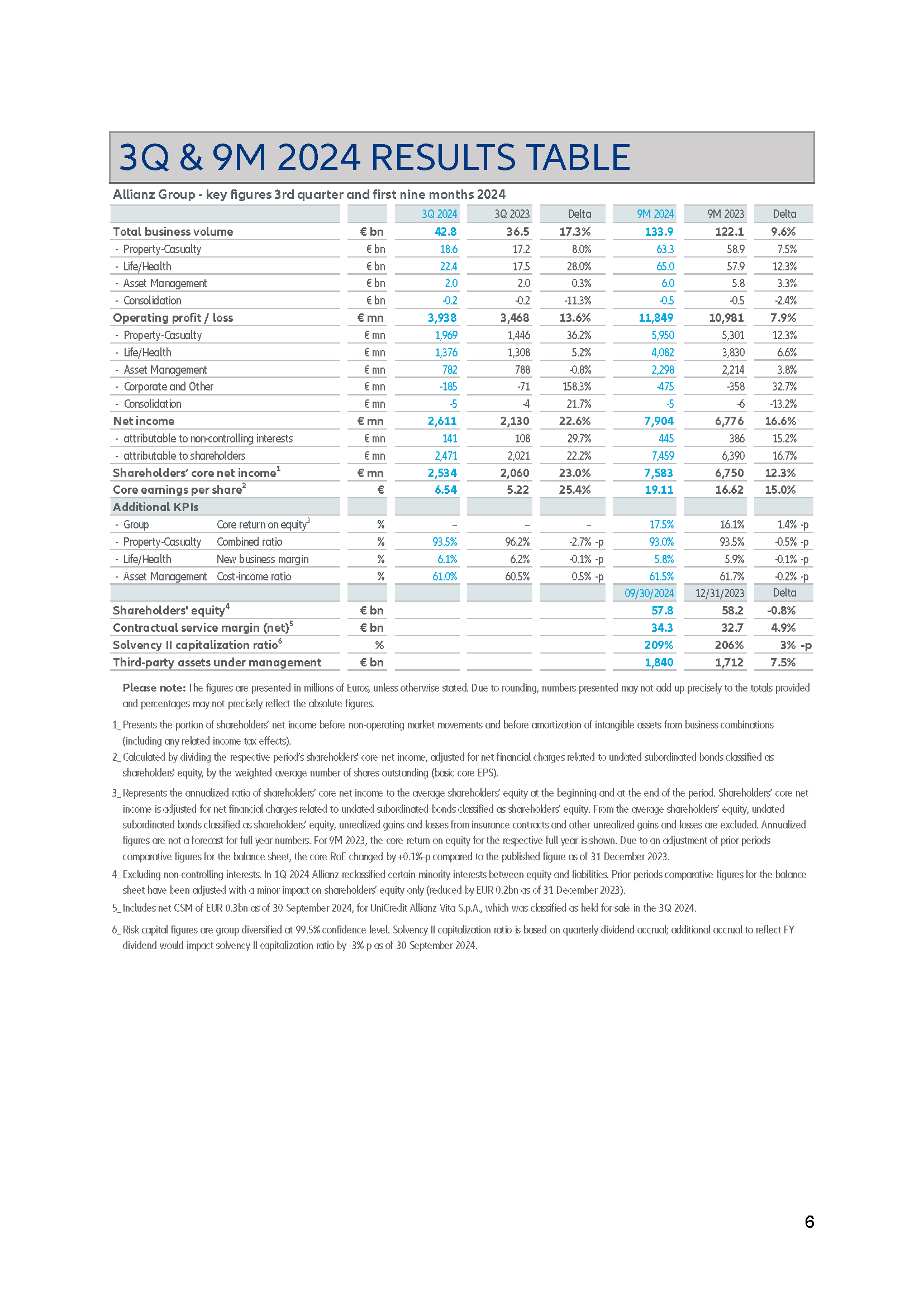

EARNINGS RELEASE: 3Q AND 9M 2024

ALLIANZ RECORDS 14 PERCENT OPERATING PROFIT GROWTH FOR THIRD QUARTER 2024 GROUP TARGETS UPPER HALF OF FULL-YEAR OUTLOOK

3Q 2024:

- Total business volume advances 17.3 percent to 42.8 billion euros

- Operating profit increases13.6 percent and reaches 3.9 billioneuros, attributable to very good results in the Property-Casualty segment

- Shareholders’ core net income reaches 2.5 billion euros, an increase of 23.0 percent

9M 2024:

- Total business volume rises 9.6 percent to 133.9 billion euros

- Operating profit increases by 7.9 percent to 11.8 billion euros driven by all business segments

- Shareholders’ core net income advances 12.3 percent to 7.6 billion euros

- Strong Solvency II capitalization ratio of 209 percent1

Outlook:

Following the strong performance in the first nine months of the year, Allianz expects the 2024 operating profit to be in the upper half of the target range of 14.8 billion euros, plus or minus 1 billion euros2

The previously announced share buy-backs in the total volume of 1.5 billion euros have been fully executed by October 2024

2. As always, natural catastrophes and adverse developments in the capital markets, as well as factors stated in our cautionary note regarding forward-looking statements may severely affect the operating profit and/or net income of our operations and the results of the Allianz Group.

”Allianz continued our strong performance through the third quarter, achieving strong growth in business volume, operating profit, and net income, while reinforcing our financial strength.

Natural catastrophes have again tested Allianz’s financial and operational resilience, tests which we have successfully passed,giving us the confidence to now expect an operatingprofitintheupperhalfofourtargetrange.Theseeventsprofoundlyaffected many of our customers, but they also presented us with another opportunity to demonstrateourpurposeanddeliverthesecurityofbeinginsured byAllianz.

Moreover,inaworldwherebrandstrengthisincreasinglyimportant,Allianzhasagain beenrecognized as the world’s leading insurance brandand has entered the Top 30 Global Brands in the latest Interbrand Ranking. Our fast-growing brand value underscoresourabilitytotranslatecustomer-centricityintoprofitablegrowthforour shareholders.”

-OliverBäte,ChiefExecutive Officer of AllianzSE

FINANCIAL HIGHLIGHTS

Total business volume

3Q 2024:

Totalbusinessvolumeroseby17.3percentto42.8billioneuros.Thisincreasewasdrivenby sustained momentum across our insurance segments.

Adjustedforforeigncurrencytranslationand consolidationeffects,internalgrowthwas 19.1percent.The maindriverswerethe Life/Healthoperationswithgood contributionalsofromour Property-Casualty businesssegment.

9M 2024:

Totalbusinessvolumeincreasedby9.6percentto133.9billion euros. Adjustedforforeigncurrencytranslationandconsolidationeffects,internalgrowthwas11.1percent.All business segments contributedto this growth.

Earnings

3Q 2024:

Operating profit was excellent at 3.9 (3Q 2023: 3.5) billion euros. The strong increase of 13.6 percent was primarily driven by the Property-Casualty business with good growth also in the Life/Health segment.

Shareholders’ core net income advanced to 2.5 (2.1) billion euros, an increase of 23.0 percent.

Net income attributable to shareholders rose to 2.5 (2.0) billion euros driven by a higher operating profit, and a better non-operating result.

9M 2024:

Operating profit was strong at 11.8 (9M 2023: 11.0) billion euros, an increase of 7.9 percent. All business segments contributed, with our Property-Casualty business being the main driver.

Net income attributable to shareholders increased by 16.7 percent to 7.5 (6.4) billion euros driven by operating profit growth, and a higher non-operating result.

Core earnings per share (EPS)3 was 19.11 (9M 2023: 16.62) euros.

The annualized core return on equity (RoE)3 was 17.5 percent (full year 2023: 16.1 percent).

SolvencyIIcapitalizationratio

TheSolvencyIIcapitalizationratioincreasedto209percent4 attheendofthethirdquarter2024compared with206percentattheendofthesecondquarter2024.

3. Core EPS and core RoE calculation based on shareholders‘ core net income.

4. Based on quarterly dividend accrual; additional accrual to reflect FY dividend would impact Solvency II capitalization ratio by

-3%-pasofSeptember30, 2024.

SEGMENTALHIGHLIGHTS

“Allianz’s strong performance delivery in the third quarter underlines the proven resilience of our business model.

Our Property-Casualty business achieved excellent operating profit growth. We benefited from lower natural catastrophes compared to last year, which however remained at an elevated level. Continued pricing momentum and resolute business focusfuelledstronginternalgrowth,inparticularinourRetail,SMEandFleetsegment.

The performance of our Life/Health operations was excellent. Allianz’s ability for sustained value creation for shareholdersand customers alike is evidenced by a very goodoperatingprofitandexcellent new businessgrowth at attractivemargins.

OurAsset Management segmentrecorded continued netinflowsandgood growthin third-party Assets under Management. This fuelledAuM-driven revenues and positions us well for sustained earnings growth.

The strong performance throughout the first nine months of the yearenablesus to anticipate afull-year operating profitin the upper halfof the targetrangeof 14.8 billioneuros,plusorminus1billioneuros.”

- Claire-MarieCoste-Lepoutre,ChiefFinancialOfficerofAllianzSE

Property-Casualty insurance: Strong internal growth

3Q 2024:

Total business volume increased by 8.0 percent to 18.6 (17.2) billion euros. Adjusted for foreign currency translation and consolidation effects, internal growth was strong at 9.5 percent. Retail, SME & Fleet achieved excellent internal growth of 11 percent, and Commercial lines advanced by 6 percent.

Operating profit surged by 36.2 percent to 2.0 (1.4) billion euros due to a higher operating insurance service result. Natural catastrophe losses reduced compared to the prior year quarter but remained at an elevated level.

The combined ratio improved to 93.5 percent (96.2 percent). The loss ratio developed favourably and reached 69.8 percent (71.0 percent), benefiting from lower natural catastrophe claims. The expense ratio improved to 23.7 percent (25.1 percent).

9M 2024:

Total business volume increased by 7.5 percent to 63.3 (58.9) billion euros. Adjusted for foreign currency translation and consolidation effects, internal growth was very good at 8.3 percent. Retail, SME & Fleet achieved strong growth of 10 percent and Commercial lines advanced by 5 percent.

Operating profit rose by 12.3 percent to an excellent level of 6.0 (5.3) billion euros.

The combined ratio improved to 93.0 percent (93.5 percent). The loss ratio was 68.8 percent (68.5 percent), while the expense ratio improved by 0.7 percentage points to 24.2 percent.

3Q 2024:

PVNBP, the present value of new business premiums, increased strongly by 35.4 percent to 19.5 (14.4) billion euros, with double-digit growth across most regions. 94 percent of our new business was generated in our preferred lines.

Operating profit advanced to 1.4 (1.3) billion euros. Growth was widely spread across our businesses.

Contractual Service Margin (CSM) rose from 53.6 billion euros in the second quarter to 54.2 billion euros5, mainly due to the good normalized CSM growth of 1.5 percent.

The new business margin (NBM) was attractive at 6.1 percent (6.2 percent) and the value of new business (VNB) advanced to 1.2 (0.9) billion euros, an increase of 32.9 percent.

9M 2024:

PVNBP advanced to 60.6 (50.6) billion euros. Growth was favorable across most regions, with particularly strong contributions from the United States and Germany.

Operating profit increased to 4.1 (3.8) billion euros.

Contractual Service Margin (CSM) rose from 52.6 billion euros at the end of 2023 to 54.2 billion euros5, mainly due to the strong normalized CSM growth of 4.6 percent.

The new business margin was very good at 5.8 percent (5.9 percent). The value of new business advanced to 3.5 (3.0) billion euros, driven by volume growth.

5. Includes gross CSM of 0.8 billion euros and net CSM of 0.3 billion euros as of September 30, 2024, for UniCredit Allianz Vita S.p.A., which was classified as held for sale in the third quarter of 2024.

Asset Management: Strong net inflows and higher third-party AuM

3Q 2024:

Operating revenues reached 2.0 billion euros, up 1.1 percent adjusted for foreign currency translation effects. The increase was due to higher AuM-driven revenues.Operating profit amounted to 782 (788) million euros. Adjusted for foreign currency translation effects, operating profit was stable. The cost-income ratio (CIR) was 61.0 percent (60.5 percent).

Third-party assets under management increased to 1.840 trillion euros as of September 30, 2024, up by 37 billion euros from the end of the second quarter 2024. Favorable market effects of 54.6 billion euros and strong net inflows of 19.8 billion euros were partly offset by negative foreign currency translation effects.

9M 2024:

Operating revenues increased to 6.0 billion euros, up 3.7 percent adjusted for foreign currency translation effects, due to higher AuM-driven revenues.

Operating profit rose to 2.3 (2.2) billion euros, up 3.8 percent. Adjusted for foreign currency translation effects, operating profit advancedby 4.2 percent. The cost-income ratio (CIR) improved to 61.5 percent (61.7 percent).

Third-party assets under management increased by 128 billion euros from the end of 2023 to 1.840 trillion euros as of September 30, 2024. Strong net inflows of 68.2 billion euros were the main contributor with positive market effects also supporting.